India’s GST 2.0 Explained: India is rolling out GST 2.0 from 22 September 2025, a reform billed as the most significant tax reset since 2017. With fewer slabs, cheaper essentials, and heavier taxes on luxury goods, this reform aims to simplify compliance and reduce the burden on the common household. But will it deliver?

India’s GST 2.0 Explained: Key Highlights

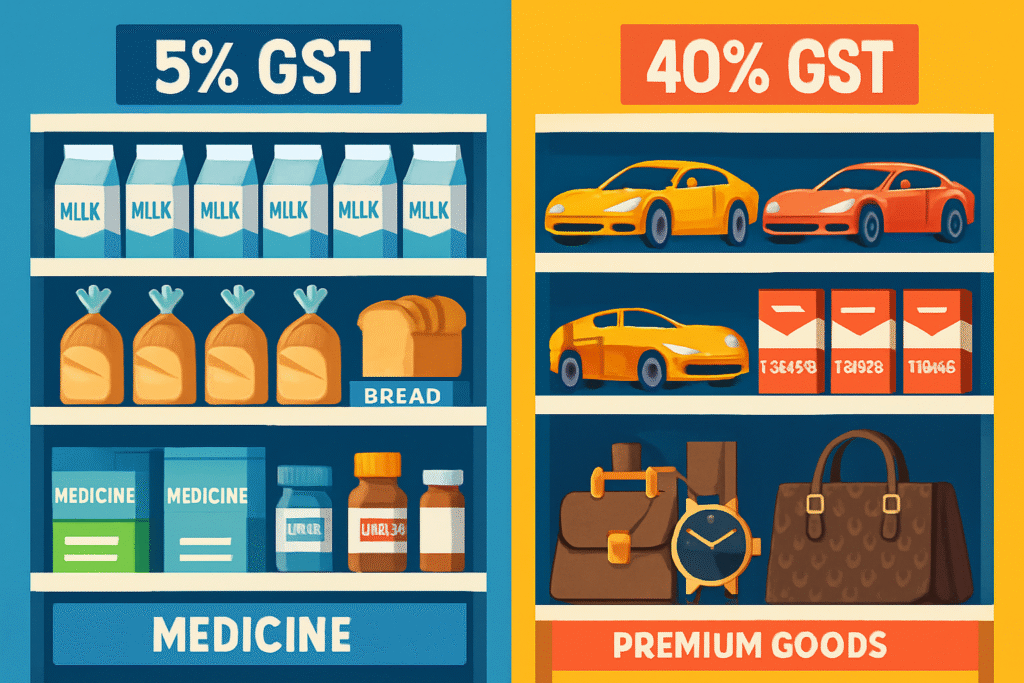

- Simplified Slabs – GST now at 0%, 5%, 18%, with a 40% slab for sin/luxury goods.

- Cheaper Essentials – Food, medicines, hygiene, and agricultural equipment see big relief.

- Autos & Electronics Benefit – Small cars, two-wheelers, ACs, TVs shift from 28% → 18%.

- Luxury Items Costlier – Tobacco, pan masala, premium cars, sugary drinks at 40%.

- Govt Oversight – Prices of 54 essential items under watch to prevent profiteering.

Also Read:RBI Monetary Policy August 2025: No Change in Repo Rate, Focus on Inflation Control

What Gets Cheaper

Essentials & Health

- UHT milk, paneer, breads: 0% GST

- Butter, ghee, spices, dry fruits: 5%

- Medicines, diagnostics, oxygen: cut to nil/5%

Personal Care & Agriculture

- Soaps, toothpaste, shampoo: 5%

- Tractors, irrigation equipment: 5%

Automobiles & Electronics

- Small cars, 2-wheelers up to 350cc: 18%

- TVs, ACs, appliances: 18%

What Gets Costlier

- Tobacco, pan masala, gutkha, sugary drinks → 40% GST

- High-end cars & premium bikes → 40% GST

- Designer apparel above ₹2,500 → 18% GST

Equine Analysis (E-E-A-T Lens)

- Experience: India’s GST had too many slabs (5%, 12%, 18%, 28%). GST 2.0 corrects this, reducing complexity.

- Expertise: Economists say lowering slabs could boost consumption in autos, FMCG, and healthcare.

- Authoritativeness: Backed by the GST Council & Finance Ministry, PIB notifications confirm rates.

- Trustworthiness: CBIC is tracking 54 essential items to ensure businesses pass on benefits to consumers.

FAQs

Q1: When do new GST rates apply?

From 22 September 2025.

Q2: What are the new GST slabs?

0%, 5%, 18%, and 40% (sin/luxury).

Q3: Will my monthly grocery bill drop?

Yes. Daily essentials, medicines, soaps, and dairy products get cheaper.

Q4: Who pays more now?

Consumers of luxury cars, tobacco, pan masala, and premium fashion.

Conclusion

GST 2.0 shifts the tax burden away from essentials and toward luxury. For the common man, groceries, medicines, and personal care will feel lighter on the wallet. For auto and electronics buyers, Navratri 2025 could be the best time to shop. But high-end consumers may cut back.

If the government’s bet works, consumption will rise, revenue losses will balance out, and India’s middle class may finally feel some relief.

GST 2.0 India,